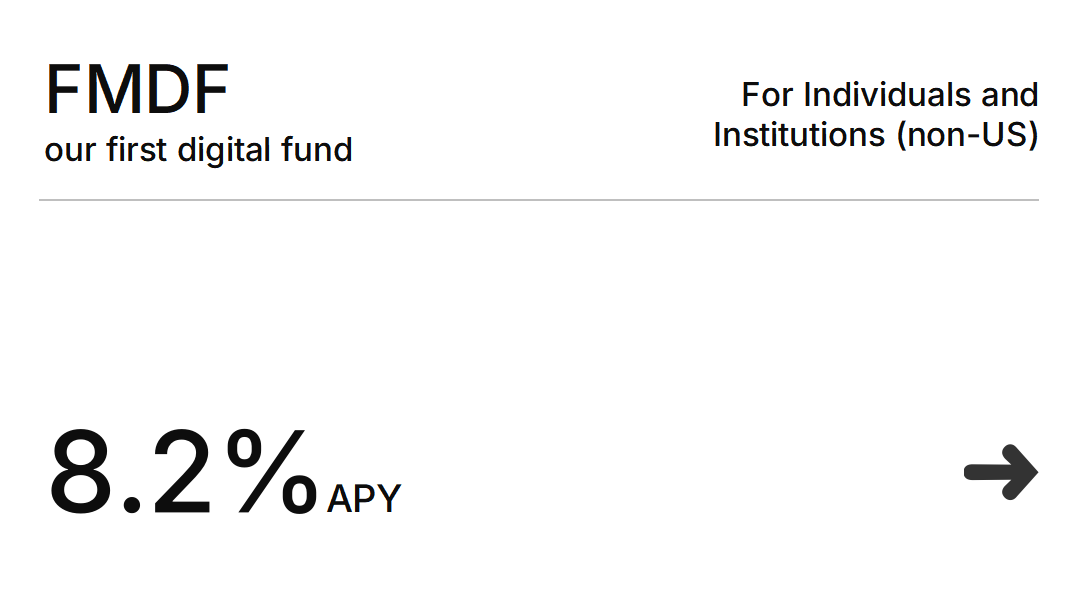

Future Matrix Digital Fund

Upgraded RWA fund, combining traditional assets (RWA) and crypto assets (CWA), providing investors with robust investment returns

Fund Overview

Future Matrix Digital Fund (FMDF) is a BVI fund managed by BlockStone, supporting fiat and cryptocurrency subscriptions, investing in low-risk assets in traditional financial markets and cryptocurrency markets.

FMDF is positioned as a low-risk fund, primarily investing in high-security interest-bearing assets in traditional asset areas and cryptocurrency areas, such as US Treasury bonds, short-term deposits, notes, and various high-security lending, staking, and DEX platforms.

The fund aims to bring investors low volatility and relatively stable returns. Before the establishment of FMDF, BlockStone had an internal fund that had been operating stably for many years, which can serve as a reference for performance.

Portfolio Overview

Current NAV

$110.63

+$0.0122 today

APY

10.6%

30-day average

AUM

$28.5M

Total assets under management

Holdings

| Asset | Type | Allocation | Yield | Maturity |

|---|---|---|---|---|

| US Treasury 10-Year Notes | Government Bond | 20% | 4.2% | 10 years |

| US Treasury 2-Year Notes | Government Bond | 15% | 3.8% | 2 years |

| BUIDL Fund | Crypto Fund | 10% | 5.5% | N/A |

| Corporate Bond ETF | Fixed Income | 25% | 4.5% | Various |

| USDC Lending | Stablecoin | 20% | 6.2% | 30 days |

| Bitcoin ETF | Crypto | 5% | N/A | N/A |

| Cash Reserves | Cash | 5% | 2.0% | N/A |

Fund Details

Fund Elements

- ✓

Minimum Subscription

$100,000, increments of $10,000

- ✓

Management Fee

0%

- ✓

Performance Fee

10%

- ✓

Investor Eligibility

Global investors (except US citizens)

- ✓

Subscription Method

Supports fiat and cryptocurrency subscriptions

Investment Strategy

FMDF focuses on low-risk, stable-yield investment strategies, investing in high-security interest-bearing assets in traditional financial markets and cryptocurrency markets.

- ✓

Traditional Financial Markets

US Treasury bonds, short-term deposits, notes, and other traditional financial products

- ✓

Cryptocurrency Markets

High-security lending and staking platforms and decentralized trading platforms

- ✓

Risk Management

Diversified asset allocation, strict risk control processes

Performance

Historical performance of our internal fund, which serves as a reference for FMDF's expected performance.

10.6%

Annualized Return (2024)

2.1%

Maximum Drawdown

0.92

Sharpe Ratio

Asset Allocation

Current Allocation

Allocation Strategy

Our allocation strategy is designed to balance stability and growth, with a primary focus on capital preservation.

- ✓

Fixed Income Focus

60-80% allocation to traditional fixed income securities for stability

- ✓

Digital Asset Integration

15-35% allocation to carefully selected digital assets for enhanced returns

- ✓

Liquidity Reserve

5-10% maintained in cash and highly liquid assets for opportunities and redemptions

Key Benefits

Professional Management

Benefit from our team's extensive experience in both traditional finance and digital assets, with a proven track record of managing over $10 billion in assets throughout their careers.

Diversified Exposure

Gain exposure to both traditional financial markets and digital assets through a single investment vehicle, providing diversification across asset classes.

Institutional-Grade Security

Rest assured with our robust security protocols, comprehensive risk management framework, and strict compliance with regulatory requirements.

Start Investing in FMDF Fund

Through the tons.money platform and Telegram built-in app, easily invest in the FMDF fund and get stable returns