Introducing USD8

∞∞ Infinity Dollar ∞∞

USD8(Infinity Dollar) is a stablecoin that is 1:1 pegged to USD. It is fully backed by USDC and USDT generating yield from blue-chip DeFi protocols. Experience the stability of traditional stablecoins with the added benefit of passive yield generation.

Benefits of sUSD8

Earn yield by staking USD8 to sUSD8. sUSD8 holders do not need to claim their rewards manually. The rewards are accumulated within the staking contract, which increases its "value" overtime.

Auto-Compounding

Rewards automatically compound without manual intervention

Increasing Value

sUSD8 value increases over time as rewards accumulate

Gas Efficient

No need for frequent transactions to claim rewards

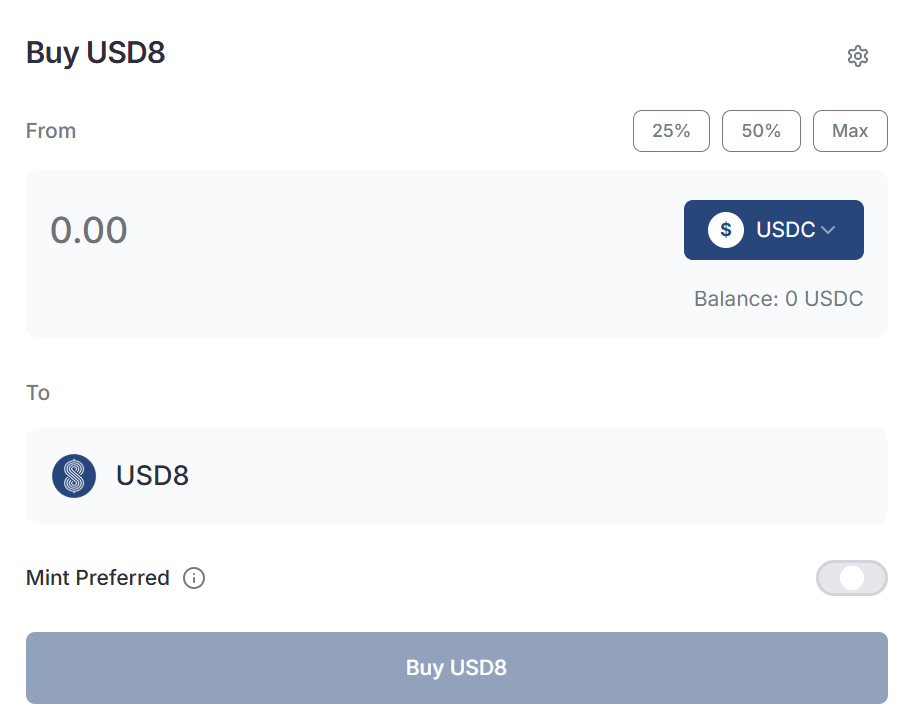

How to get USD8

Select an Asset

USD8 is built on Ethereum. You can use USDT and USDC for transactions.

Mint or Swap

You can acquire USD8 through a DEX exchange or directly via the Mint function.

Receive USD8

Receive USD8 instantly, ready for use or investment - a seamless addition to your digital wallet.

Integrated with the best

USD8 is integrated with leading DeFi protocols to maximize yield opportunities while maintaining security and stability. Our partnerships with blue-chip protocols ensure reliable and sustainable returns.

Pendle

Morpho

Euler

Curve

How it works?

Frequently asked questions about USD8 and sUSD8